Early-stage fintech startups simply acquired a brand new funding supply

[ad_1]

Welcome to The Interchange! For those who acquired this in your inbox, thanks for signing up and your vote of confidence. For those who’re studying this as a put up on our web site, enroll right here so you may obtain it immediately sooner or later. Each week, I’ll check out the most popular fintech information of the earlier week. This can embrace all the things from funding rounds to traits to an evaluation of a selected area to scorching takes on a selected firm or phenomenon. There’s numerous fintech information on the market and it’s our job to remain on prime of it — and make sense of it — so you may keep within the know.

Hey! I’m excited to report the introduction of two new additions to this text. First, the superb Christine Corridor shall be co-writing with me shifting ahead. Christine and I’ve really identified one another for 19 years, having used to work collectively on the Houston Enterprise Journal. She’s been overlaying fintech for the previous few years and I’m thrilled she shall be engaged on The Interchange with me shifting ahead. Second, should you learn to the tip, you’ll see a emblem created only for the Interchange by TC’s unimaginable graphic designer, Bryce Durbin. I’m ridiculously enthusiastic about it. — Mary Ann

Thanks a lot to Mary Ann for that greeting! I’m excited to be working together with her in overlaying the broad world of fintech and sit up for contributing to what I biasedly take into account the go-to publication for this business. — Christine

Now on to the information.

Celebrating female-led ventures

I, as a lot of you I’m positive, proceed to be disenchanted within the lack of LP (restricted accomplice) {dollars} flowing towards female-led enterprise capital corporations. So you may think about my pleasure after I acquired an electronic mail a couple of new enterprise agency, known as Vesey Ventures, that was based by three feminine former managing administrators of Amex Ventures who had not too long ago closed a $78 million debut fund.

Vesey’s self-described mission is to again corporations “remodeling monetary companies” on the seed to Sequence B phases. It plans to speculate $1.5 million to $3 million as preliminary checks, and bigger quantities for follow-ons. Primarily based in the US and Israel, the fund has up to now backed 5 startups, together with Coast, Cyrus, Grain, Equi and Correct.

The trio wouldn’t say whether or not Amex is an LP in its new fund however implied there have been no onerous emotions after they all determined to depart (at the very same time in late 2021, thoughts you). Personally, moreover the truth that this implies more cash on the market for fintech startups, I do love that Dana Eli-Lorch, Lindsay Fitzgerald and Julia Huang labored collectively for a couple of decade and acquired alongside so nicely as colleagues and mates that they determined, “Hey, let’s do that on our personal.”

Clearly, their monitor document impressed sufficient LPs — together with seven “distinguished” unnamed monetary establishments — that they have been in a position to shut the fund in a really difficult macroenvironment. Throughout their time at Amex, they labored on investments in corporations akin to Plaid, Stripe, Melio and Trulioo. Additionally they labored lots on serving to fintechs construct partnerships with incumbent monetary establishments — expertise they plan to make use of to supply portfolio corporations bespoke “Technique Sheets” alongside time period sheets.

Vesey defines fintech in its broadest sense — which means that it invests outdoors of conventional classes of economic companies akin to shopper and B2B. It additionally seems at vertical software program, embedded fintech, the way forward for commerce and the infrastructure layer — akin to cybersecurity, threat and compliance.

It made my week to have the chance to cowl this information, not going to lie. Right here’s to more cash flowing to feminine traders, and founders, too!!

Talking of which, I additionally coated the $15 million elevate for Kindred, a home-swapping community. Whereas that firm is extra proptech than fintech, I’m mentioning it as a result of it was additionally based by ladies who beforehand labored collectively — on this case, at Opendoor — and noticed a chance to department out on their very own. — Mary Ann

Vesey Ventures founding companions Lindsay Fitzgerald, Dana Eli-Lorch and Julia Huang Picture Credit: Vesey Ventures

Fintech funding in Q1

This week, we took a take a look at world fintech funding for the primary quarter of 2023 and located some notable tidbits.

First issues first, funding for the quarter totaled $15 billion, which is up 55% from the fourth quarter, however clearly exhibiting a market correction because of the staggering quantities fintech corporations raised in each 2021 and 2022.

And, it’s necessary to notice that of that $15 billion, $6.5 billion was Stripe’s elevate. With out that deal, CB Insights mentioned funding would have amounted to $8.5 billion, or a 12% drop in funding from the fourth quarter of 2022.

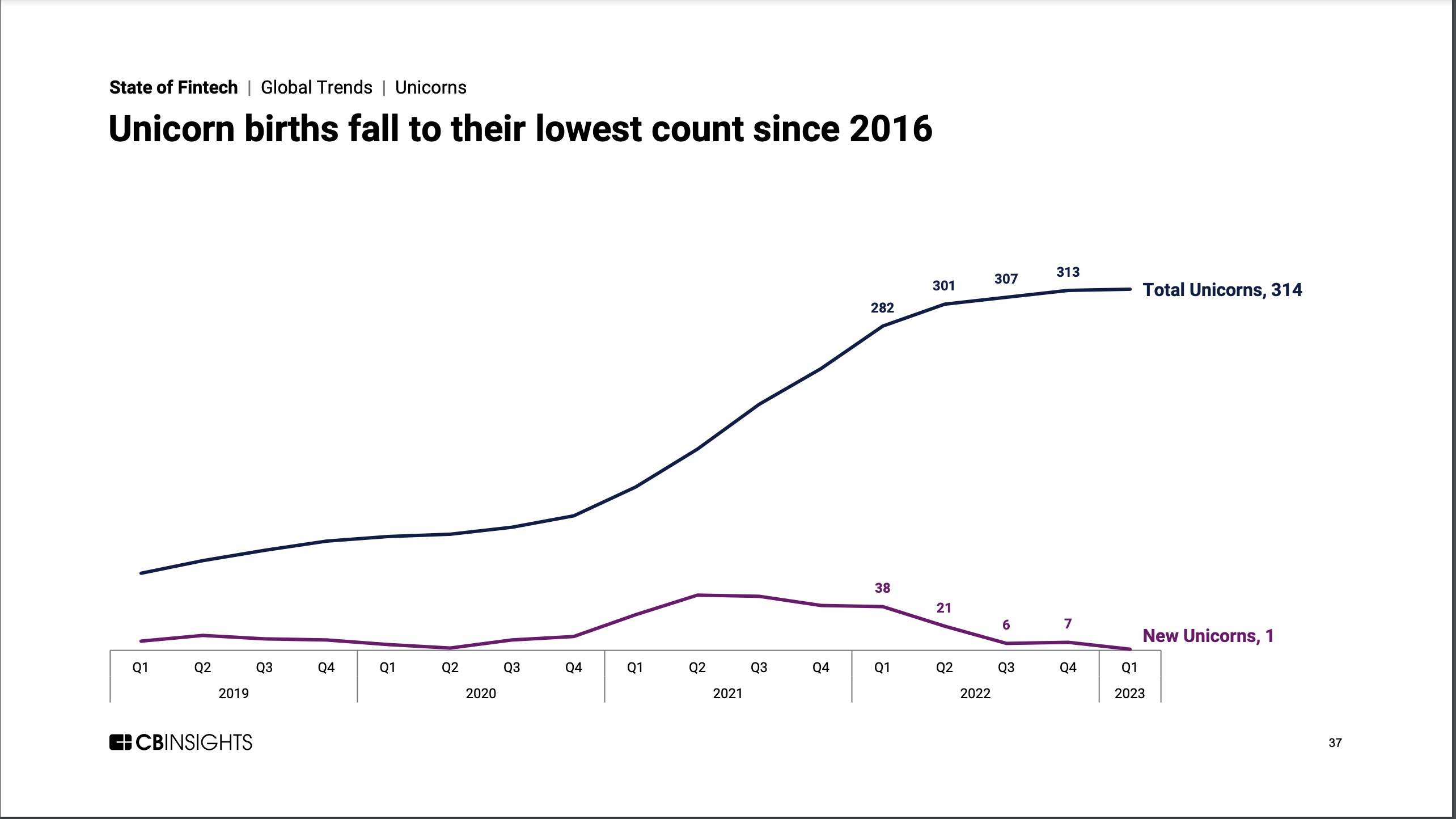

In the meantime, 2022 was flush with fintech corporations reaching unicorn standing, with 72 unicorns minted that 12 months, and 38 within the first quarter alone. That was seemingly aided by the plethora of accessible capital flowing into the sector, nonetheless; within the first quarter of 2023, only one fintech firm was minted a unicorn: Egypt-based MNT-Halan, which in early February raised $260 million in fairness financing at a $1 billion valuation. In keeping with the CB Insights’ newest State of Fintech report, that is the primary time that has occurred for the reason that finish of 2016.

Although MNT-Halan was the one firm to earn a horn, the primary quarter was ripe with “megarounds,” the time period for offers valued at $100 million or extra. There have been 16 offers like this, totaling $9.2 billion, a rise of 179% over the fourth quarter of 2022 and accounting for 61% of whole funding within the first quarter, CB Insights reported. After Stripe’s $6.5 billion deal got here Rippling, which raised $500 million in mid-March as Silicon Valley Financial institution was melting down. Notably, deal depend was down, dropping 24% quarter over quarter. — Christine

Picture Credit: CB Insights

Apple pushes additional into fintech

Does each tech firm need to change into a fintech? As reported by Romain Dillet: “Apple Card clients within the U.S. can now open a financial savings account and earn curiosity by way of an Apple financial savings account. To study the specifics about Apple’s new providing, click on right here. When the corporate initially introduced the brand new monetary product again in October, Apple mentioned that it couldn’t share what rate of interest could be paid out on these accounts as a result of charges are fluctuating a lot today. As of right this moment, Apple goes to supply an APY of 4.15%.” You may learn extra particulars on the transfer right here.

In the meantime, Moody’s Buyers Service issued a brand new report summarizing its view that customers’ means to understand greater yields on their money by way of the tech big’s new financial savings account (which is being provided in partnership with Goldman Sachs) — if nicely built-in into the Apple ecosystem — “is credit score unfavorable for incumbent banks and money alternate options akin to cash market funds.”

As we all know, the brand new financial savings account deepens Apple’s providing of economic companies merchandise, which already features a digital pockets, bank card and its purchase now, pay later credit score providing, Apple Pay Later. As Moody’s factors out, “the growth aligns with a typical expertise agency technique to extend the scope, utility and enchantment of their digital platforms.”

“If Apple promotes the financial savings product aggressively, it may entice a major quantity of financial savings to the Apple ecosystem and away from conventional banks. Via the partnership, Goldman Sachs may benefit from elevated deposit funding by way of the broad attain of Apple’s digital ecosystem,” mentioned Stephen Tu, a vp with Moody’s Buyers Service, in a written assertion.

Moody’s additional added: “Whereas there are already many higher-yielding money alternate options out there for many shoppers, Apple’s higher-than-average price of curiosity on the account mixed with its easy and simple to make use of ecosystem may incentivize shoppers to shift funds to the Apple platform from incumbent monetary establishments.” — Mary Ann

(Disclosure: My husband works for Apple, however not in any capability associated to this challenge.)

Different weekly information

Lili claims tremendous app standing with new accounting platform

Greenwood — a digital banking platform for Black and Latino people and companies — goes dwell for all, cancels waitlist (TechCrunch coated the corporate’s 2021 $40 million elevate right here.)

UK-based Finastra companions with Plaid to present customers entry to fintech apps

Airbase provides guided procurement to spend administration platform

On-line actual property agency Opendoor cuts 22% of workforce (TechCrunch coated the corporate’s earlier spherical of layoffs, which affected 18% of its workers at the moment, final November.)

Bain Capital Ventures’ Matt Harris revealed a chunk on how banks must be working with startups: Classes from Historical Rome: How banks can study to like startups

Fundings and M&A

Seen on TechCrunch

Accounting automation startup Trullion lands $15M funding

And elsewhere

Wealthtech-proptech-fintech crossover Plotify raises $12.5 million in fairness financing

Actor Ryan Reynolds Buys Place in Canadian Funds Tech Firm Nuvei

Insurtech Capitola raises $15.6M Sequence A from Munich Re

Clerkie raises $33M Sequence A funding from prime traders to deal with the damaged debt system

French expense administration agency Mooncard luggage €37M Sequence C funding

YELO Funding, a university financing startup, declares $1.2 million in pre-seed funding

TiiCKER, a shareholder loyalty and engagement platform, raises $5M in seed spherical

Residential expertise firm Habi receives $100M credit score facility from Victory Park Capital

Waste administration funds startup CurbWaste raises $4M

Now, right here’s that emblem I promised! Isn’t it fairly?!

Picture Credit: Bryce Durbin

That’s it for this week. It felt a bit of gradual however hey, typically, that’s okay 🙂 Hope you all are having unbelievable and fun-filled weekends! See you subsequent time. xoxoxo, Mary Ann and Christine

[ad_2]

No Comment! Be the first one.