AWS and Microsoft in UK crosshairs as Ofcom mulls cloud companies market investigation

[ad_1]

U.Ok. regulator Ofcom has given its first indication that it’s getting ready to refer the native cloud infrastructure companies marketplace for an in-depth investigation, with the practices of Amazon and Microsoft specifically in its crosshairs because of their market share.

The information comes some six months after Ofcom first revealed it was kickstarting a market research into the £15 billion U.Ok. cloud market, with the so-called massive three “hyperscalers” of Amazon, Microsoft, and Google firmly in its crosshairs.

It’s price noting that Ofcom’s session, which entails soliciting stakeholder suggestions from throughout the cloud business, is barely at its midway level. However right this moment Ofcom confirmed that it has “provisionally recognized” practices that make it harder for enterprise prospects to change between cloud suppliers, and even use a number of suppliers, which is why it’s “proposing” to refer the cloud companies market to the Competitors and Markets Authority (CMA) for a proper investigation.

“We’ve executed a deep dive into the digital spine of our economic system, and uncovered some regarding practices, together with by a few of the greatest tech companies on the planet,” Fergal Farragher, Ofcom’s director chargeable for the market research, mentioned in a press launch. “Excessive obstacles to switching are already harming competitors in what’s a fast-growing market. We predict extra in-depth scrutiny is required, to ensure it’s working nicely for folks and companies who depend on these companies.”

Friction

The crux of the issue, in accordance with Ofcom, is that Amazon, Microsoft, and Google collectively account for greater than 80% of cloud revenues within the U.Ok., they usually could embody insurance policies and restrictions that make it troublesome for different smaller suppliers to achieve traction. These embody so-called “egress charges,” which are sometimes opaque charges that cloud corporations cost every time an organization transfers knowledge out of the cloud and strikes it elsewhere — that is usually seen as an unscrupulous means to lock prospects in, as they’re usually larger than what it prices to switch knowledge inside a single supplier’s cloud.

Elsewhere, Ofcom additionally factors to points round interoperability, whereby the large cloud companies create their merchandise in order that they don’t play properly with competing suppliers — this may put a substantial resource-drain on corporations trying to undertake a hybrid cloud method. Associated to this, Ofcom additionally says that the large cloud distributors usually supply “dedicated spend reductions,” which whereas lowering the shoppers’ prices, additionally encourages them to stay with a single vendor even when higher options could exist.

Ofcom notes in its preliminary findings:

These market options could make it troublesome for some present prospects to cut price for an excellent take care of their supplier. There are indications that is already inflicting hurt, with proof of cloud prospects dealing with important worth will increase after they come to resume their contracts.

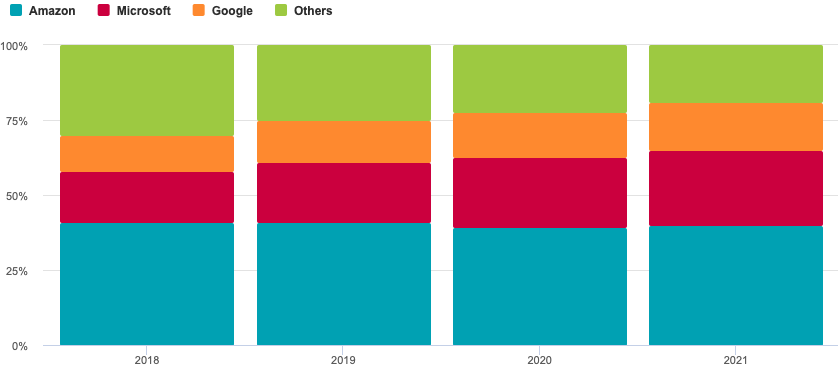

Ofcom has beforehand pointed to market share knowledge that highlights the rising market share of the hyperscalers. From 2018 to 2021, the “others” class within the U.Ok. cloud market fell from 30% to 19%, whereas in tandem the large cloud corporations both gained important market share, or remained across the similar. Microsoft has truly seen the largest development, rising from 17% to 25% over the four-year interval, whereas Google jumped from 12% to 16% market share. AWS, in the meantime, has fallen marginally from 41% to 40%, however stays by far the one greatest cloud supplier.

Market share of provide by income in UK public cloud infrastructure companies market Picture Credit score: Ofcom / Synergy Analysis Group

Whereas all three of the big-name cloud gamers are a part of its focus, Ofcom’s report appears to pinpoint AWS and Microsoft particularly, on condition that they reportedly account for cloud income spend of between 60% and 70% between them.

Furthermore, Ofcom is fast to emphasize that its focus lies not a lot on competitors on the signing-up stage, it’s extra about how troublesome issues grow to be to change after an organization has signed up. The report notes:

We provisionally discover that there’s proof of energetic competitors for brand new prospects, and that some prospects are more likely to have some bargaining energy when first migrating to the cloud. Nevertheless, as soon as a buyer makes its preliminary alternative of cloud supplier, their bargaining energy is decreased, and the steadiness of energy shifts to the preliminary cloud supplier – most frequently AWS or Microsoft.

Darkish cloud

Throughout the water in mainland Europe, the same episode has additionally been unfolding. Cloud Infrastructure Companies Suppliers in Europe (CISPE), a not-for-profit commerce affiliation, filed an antitrust grievance towards Microsoft again in November, alleging that Microsoft was utilizing its dominance in enterprise software program to tether its prospects to Azure. It’s price noting that Amazon’s AWS is a member of CISPE, and AWS has a transparent curiosity in making an attempt to stymie any positive aspects Microsoft continues to make on its profitable cloud enterprise.

Nevertheless, different smaller gamers within the cloud house, together with France’s OVHcloud, have additionally been making noises about Microsoft’s practices to European regulators, with experiences rising final week that Microsoft was near agreeing a deal to placate them — prompting Google, of all corporations, to accuse Microsoft of anti-competitive practices.

In response to right this moment’s announcement from Ofcom, CISPE Secretary Common Francisco Mingorance mentioned that it’s “clear that Ofcom recognises the potential for Microsoft’s unfair software program licensing practices to distort competitors within the cloud market,” a press release that conveniently ignores CISPE-member AWS’s involvement in Ofcom’s preliminary market research.

“Increasingly prospects, rivals and regulators are waking as much as the methods through which Microsoft continues to distort honest competitors within the cloud,” Mingorance mentioned. “Personal offers are unlikely to unravel these sector-wide points. Based mostly on the mounting proof, it’s important that each nationwide and EU authorities open formal investigations into Microsoft’s unfair software program licensing practices as an pressing competitors situation.”

Ofcom’s market research continues to be at its midway level, and is topic to extra suggestions primarily based on Ofcom’s provisional findings, with stakeholders given a agency Might 17, 2023 date to submit responses. The ultimate report and proposals is anticipated “no later than” October 5.

[ad_2]

No Comment! Be the first one.