Right here’s why slashing insulin costs will really save Large Pharma cash

[ad_1]

Heavyweight insulin maker Novo Nordisk stated Tuesday that it’ll decrease record costs for a few of its insulin merchandise by as much as 75 p.c by the tip of the yr, following within the footsteps of Eli Lilly, which made the same announcement in the beginning of the month. Consultants count on the third prime insulin maker within the US, Sanofi, will observe swimsuit.

The value cuts come after years of escalating public backlash to the businesses’ steep worth hikes on insulin, which many advocates have described as worth gouging. An evaluation from 2018 discovered that insulin record costs had been set five- to ten-times larger within the US than in different high-income international locations, with common standardized items of insulin going for practically $100. The price of producing the merchandise, even the newer insulins, typically falls below $10.

In its announcement Tuesday, Novo Nordisk stated that it’ll reduce the costs of a number of merchandise, together with Levemir, Novolin, NovoLog, and NovoLog Combine 70/30. With the 75 p.c reduce, a 10mL vial of NovoLog will drop from $289.36 to $72.34. A NovoLog Combine 70/30 FlexPen will drop from $558.83 to $139.71.

Amid public outrage over the costs, lawmakers have additionally been engaged on methods to pressure costs down. The businesses’ voluntary worth cuts intently observe a federal worth cap that went into impact this yr by way of the Inflation Discount Act of 2022. The regulation limits out-of-pocket insulin prices to $35 monthly for Medicare Half D beneficiaries. When Eli Lilly slashed its costs earlier this month, it additionally introduced applications that cap month-to-month insulin prices to $35 for folks with business insurance coverage in addition to the uninsured. Novo Nordisk didn’t supply such a cap in its announcement as we speak, although it famous a hodgepodge of offers and applications.

However, whereas the value cuts could seem linked to final yr’s Inflation Discount Act, well being coverage specialists and lawmakers notice {that a} barely older regulation could also be the actual impetus behind the dramatic cuts—the American Rescue Plan of 2021. The regulation contained various provisions to enhance healthcare entry and affordability, together with one which eliminates a cap on rebates that drug corporations are required to pay Medicaid. If the cap was lifted with insulin record costs set as they’re now, insulin makers might need needed to pay Medicaid applications extra than the value of their insulin merchandise each time a Medicaid program needed to cowl one, possible totaling tens of thousands and thousands of {dollars} in funds to Medicaid. However, with the decrease record costs, Eli Lilly and Novo Nordisk will dodge these additional funds. The rebate cap is about to elevate January 1, 2024—which can be when the businesses’ worth cuts will absolutely kick in.

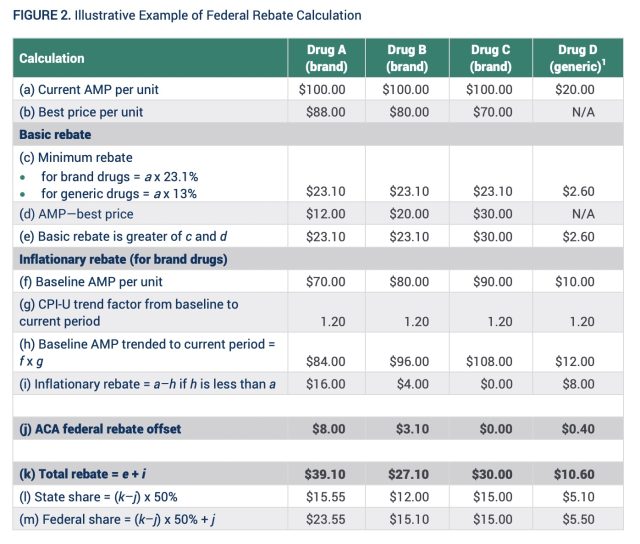

The rebate program cap is just a little difficult, so this is a breakdown of the way it works. All of it stems from the Medicaid Drug Rebate Program (MDRP), handed by Congress below the Omnibus Funds Reconciliation Act of 1990. The simple aim of the MDRP was to guarantee that Medicaid paid the bottom or absolute best worth for pharmaceuticals. As such, drug makers who need their medicine lined by Medicaid must enter right into a rebate settlement, below which Medicaid agrees to cowl and buy their merchandise so long as the drug makers pay them again a rebate to maintain prices as little as attainable. The price of the rebate is predicated on a set of formulation that contemplate issues like the kind of drug—model or generic—and market costs.

Chilly calculations

For a model drug, the fundamental rebate {that a} drug maker can pay Medicaid is 23.1 p.c of the common producer worth or the distinction between the common worth and the perfect (lowest) worth, whichever is larger. In an instance laid out by the federal Medicaid and CHIP Cost and Entry Fee (MACPAC), if a model drug has a mean producer worth of $100, and the perfect market worth is $88, the drug maker can pay the usual share, equaling $23.10, for the fundamental rebate. However, if the common worth is $100 and the perfect worth is $70, the fundamental rebate can be $30.

There’s another key factor to the rebate calculation, although: inflation. If a drug maker raises its costs quicker than inflation, then the drug maker has to additionally pay again the distinction between the present common worth and the value the drug would have been if worth will increase had merely matched inflation. That is calculated based mostly on a “baseline” common producer worth—which is regardless of the drug’s common worth was proper earlier than the rebate program began, or, for brand new medicine, the drug’s preliminary common producer worth. With that baseline worth, Medicaid applications calculate what a present worth can be based mostly on basic inflation, i.e. the Client Worth Index for All City Shoppers (CPI-U). Then, Medicaid subtracts the baseline-trended worth from the present common worth and drug makers pay the distinction on prime of the fundamental rebate—however, solely to a degree.

Underneath present regulation, the rebate was capped on the present common worth. That’s, drug makers would not be required to pay a rebate that exceeded 100% of their drug’s common producer worth. However, with drug costs skyrocketing effectively previous inflation, that meant some huge cash was left on the desk. A federal evaluation of drug rebates in 2012, as an illustration, discovered that 54 p.c of name drug rebates had been from the inflationary part. And in 2019, the rebate cap allowed drug makers to keep away from paying a whopping $3 billion in rebates, in response to a Congressional funds workplace estimate.

Primarily based on the present costs for insulin, Eli Lilly and Novo Nordisk would simply find yourself paying Medicaid rebates that exceed the common producer worth of their medicine, due to the businesses’ steep worth will increase that blew previous charges of inflation over time. For example, Sean Dickson, a drug-pricing knowledgeable on the nonprofit West Well being Coverage Middle, instructed Politico that Medicaid would have ended up producing an estimated $150 in income for each vial of Humalog it lined, amounting to about $140 million in annual Medicaid funds from Eli Lilly.

With the record costs now set to fall, Medicaid could find yourself paying greater than it did earlier than for insulin merchandise, although it is unclear by how a lot.

[ad_2]

No Comment! Be the first one.