That slowdown you feel, by the numbers

[ad_1]

It’s greater than a sense. In line with new knowledge popping out from the analysis agency Pitchbook and the Nationwide Enterprise Capital Affiliation, enterprise corporations are elevating — and deploying — quite a bit much less cash than lately.

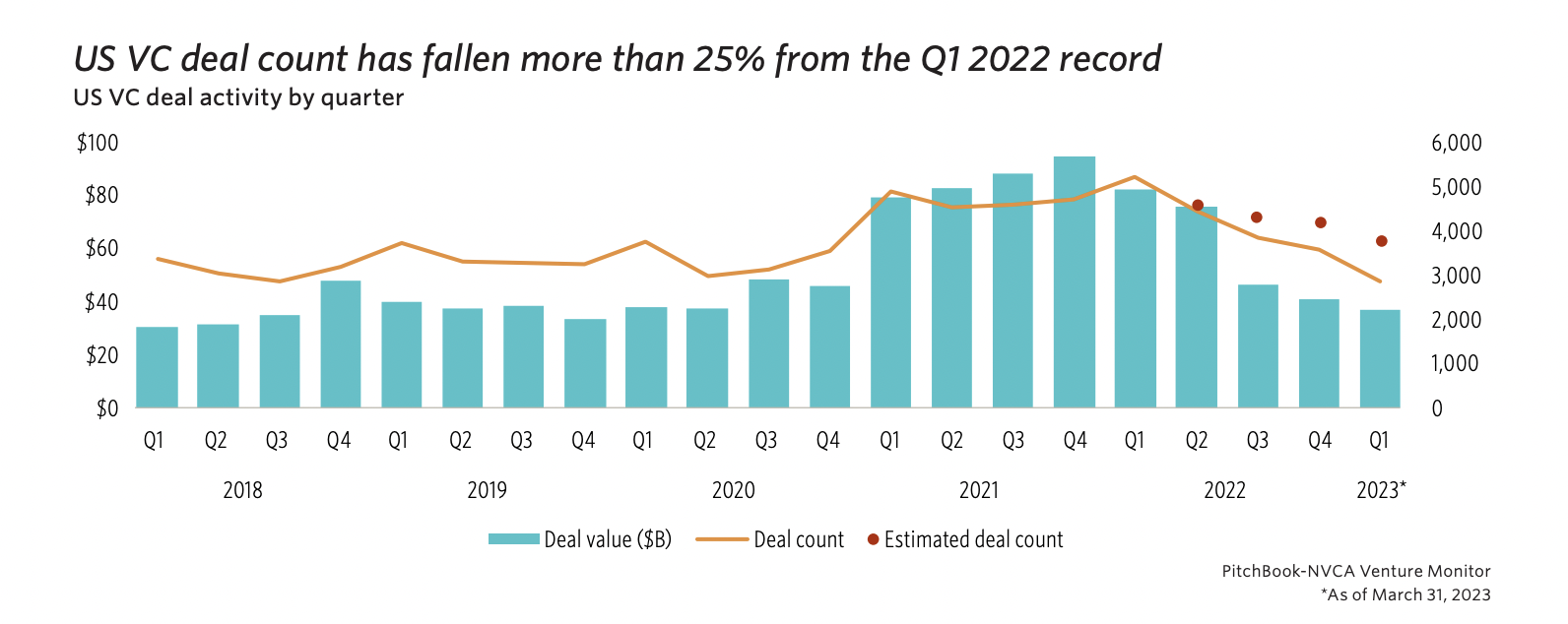

What to know: total deal rely within the U.S. has fallen greater than 25% between the primary quarter of final yr and this yr. Lower than 3,000 offers have been closed between the beginning of the yr and the tip of March, which doesn’t sound so horrible till you notice issues haven’t been so gradual, comparatively, since 2018 (see chart under).

Late-stage deal worth additionally dropped like a boulder within the first quarter. Whereas it’s apparent from latest headlines that the period of the “mega spherical” has come and gone (for now), it’s one thing else to learn that late-stage values have declined for the seventh straight quarter to $11.6 billion, in line with Pitchbook and the NVCA. The 2 say that simply 19 late-stage mega rounds occurred within the first quarter of 2023, in contrast with a surprising 98 in Q1 2022.

Unsurprisingly, that slowdown, or right-sizing, or no matter you favor to name it, has had ripple results. Within the first quarter, per the organizations’ findings, the median late-stage, pre-money valuation fell 16.9% from the 2022 full-year determine to $54 million, whereas the common pre-money valuation declined by greater than $100 million to $159 million.

The business is getting squeezed on all sides. In line with the most recent knowledge, $11.7 billion was closed throughout 99 enterprise capital funds within the first quarter of this yr — most of that cash raised by larger-size automobiles and the lion’s share, seemingly, by NEA alone, which stated in January that it closed on $6.2 billion in capital commitments throughout two new funds. Certainly, whereas simply two enterprise funds closed on $1 billion or extra within the first three months of this yr, final yr, 36 funds have been closed with greater than $1 billion in commitments.

On the similar time that they’re garnering much less in the best way of capital commitments, VCs’ portfolio firms are getting caught in a type of exit purgatory, too. In line with the NVCA and Pitchbook, simply $5.8 billion in exit worth was closed within the first quarter, which is outwardly lower than 1% of the whole exit worth generated in 2021 (it was a document yr, however ouch). With the IPO window shut tight — there have been solely 20 public listings within the first quarter — “stress continues to construct throughout the ecosystem,” observes the authors of this newest “enterprise monitor” report.

To study extra, keep tuned; subsequent week, the organizations are planning to drop much more knowledge. Within the meantime, if you need to check out a few of these numbers your self, you will discover them right here.

[ad_2]

No Comment! Be the first one.