The EV Battery Want Checklist

[ad_1]

Electrical vehicles barely existed in 2010, when the Tesla Mannequin S was nonetheless a glint in Elon Musk’s eye. Now greater than 20 million EVs girdle the globe, in accordance with BloombergNEF—and that rely is anticipated to almost quadruple to 77 million by 2025. A battery would be the high-voltage coronary heart of every of these 77 million electrical automobiles, and by far their most costly element, setting off a worldwide race to ethically supply their supplies and crank up manufacturing to fulfill exploding demand.

EVs could have seized a report 5.8 p.c of america market in 2022, in accordance with J.D. Energy, and will strategy 11 p.c of the worldwide market this yr. However consultants nonetheless imagine that higher batteries, and plenty of extra of them, are a key to EVs reaching a market tipping level, at the same time as Reuters tasks automakers spending a whopping $1.2 trillion to develop and produce EVs via 2030.

IEEE Spectrum requested 5 trade consultants to gaze deeply into their very own crystal balls and description what must occur within the EV battery house to wean the world off fossil-fueled transportation and onto the plug. Right here’s what they mentioned:

Emad Dlala, Lucid Motors, vice-president of powertrain

Upstart Lucid Motors hasn’t constructed many vehicles, however it’s constructed a fame with the record-setting, 830-kilometer driving vary of the Air Grand Touring Efficiency sedan. That vary is a testomony to Lucid’s obsessive pursuit of effectivity: The Air makes use of the identical 2170-format cylindrical cells (equipped by Samsung SDI) as many EVs, however ekes out extra miles by way of superior battery administration, compact-yet-muscular energy models and slippery aerodynamics.

Refined chassis and battery design offers new life to “lesser” chemistries—particularly lithium iron phosphate that’s the most well liked factor in batteries all over the world—that will in any other case be uncompetitive and out of date.

One would possibly assume Lucid would name for each electrical mannequin to cowl such huge distances. As a substitute, Lucid leaders see a vibrant future in vehicles that goal for max effectivity — relatively than vary per se — by way of smaller, more-affordable batteries.

Lucid’s newest Air Touring mannequin is its best but on a per-mile foundation. Now the world’s most aerodynamic manufacturing automobile, with a 0.197 coefficient of drag, the Air Touring delivers an EPA-rated 7.44 kilometers from every onboard kilowatt hour. But propelling this full-size luxurious barge nonetheless calls for a 112 kWh battery aboard.

With all that in thoughts, the corporate is creating its subsequent technology of batteries. Extrapolating from firm targets, a future compact-size Lucid—assume the dimensions of Tesla Mannequin 3 or Mannequin Y—may decisively downsize its battery with out sacrificing helpful vary.

“Our goal is to enhance effectivity much more,” Dlala says.

“If we do a 250-mile automotive, we may have a battery that’s simply 40 kWh,” or one-third the dimensions of the Air’s. That’s the identical dimension battery as a comparatively tiny, base-model Nissan Leaf, whose lesser effectivity interprets to only 240 km of EPA-rated driving vary.

Such compact batteries wouldn’t simply save severe cash for producers and shoppers. They might require fewer uncooked and refined supplies., permitting automakers to theoretically construct many extra vehicles from a finite provide. That pack would additionally weigh about one-third as a lot as Lucid’s beefiest present battery. The upshot can be a series of positive aspects that will heat the center of probably the most mass-conscious engineer: A lighter chassis to help the smaller battery, slimmer crash buildings, downsized brakes. Extra useable house for passengers and cargo. All these financial savings would additional enhance driving vary and efficiency.

This grand design, naturally, would demand an attendant burst of charger growth. As soon as chargers are as ubiquitous and dependable as gasoline stations—and practically as quick for fillups—“then I don’t want 400 miles of vary,” Dlala says.

All this might grant the final word, elusive want for EV makers: Worth parity with internal-combustion vehicles.

“That mixture of effectivity and infrastructure will enable us to create aggressive costs versus inner combustion vehicles,” Dlala says.

Ryan Castilloux, geologist, founder and managing director of Adamas Intelligence

Castilloux says that game-changing EV battery breakthroughs should date been uncommon. But EV batteries are nonetheless central to automakers’ calculus, as they search a sustainable, inexpensive provide in a interval of explosive progress. In a market ravenous for what they see as their rightful share of kilowatt-hours, smaller or less-connected automakers particularly could go hungry.

“Everyone seems to be competing for a restricted provide,” says Ryan Castilloux. “That makes for a lumpy progress trajectory in EVs. It’s an immense problem, and one which received’t go away till the expansion slows and the availability facet can sustain.”

“In latest a long time, it wouldn’t have made sense to consider an automaker turning into a processing or mining firm, however now with shortage of provides, they should take drastic measures.”

—Ryan Castilloux, Adamas Intelligence

A battery trade that has succeeded in boosting nickel content material for stronger efficiency, and reducing cobalt to cut back prices, has hit a wall of diminishing returns by way of chemistry alone. That leaves battery pack design as a brand new frontier: Castilloux lauds the push to remove “aluminum and different zombie supplies” to avoid wasting weight and house. The hassle reveals in improvements reminiscent of large-format cylindrical batteries with greater ratios of energetic materials to surrounding circumstances—in addition to so-called “cell-to-pack” or “pack-to-frame” designs. BMW’s important “Neue Klasse” EVs, the primary arriving in 2025, are only one instance: Massive-format cells, with no conventional cased modules required, fill a whole open floorpan and function a crash-resistant structural member.

“That turns into a low-cost method to generate large enhancements in pack density and bolster the mileage of a automobile,” Castillloux says.

That form of refined chassis and battery design also can assist stage the enjoying discipline, giving new life to “lesser” chemistries—particularly lithium iron phosphate that’s the most well liked factor in batteries all over the world—that will in any other case be uncompetitive and out of date.

“Issues are transferring in the fitting course in North America and Europe, however it’s too little too late in the meanwhile, and the West is collectively scrambling to fulfill demand.”

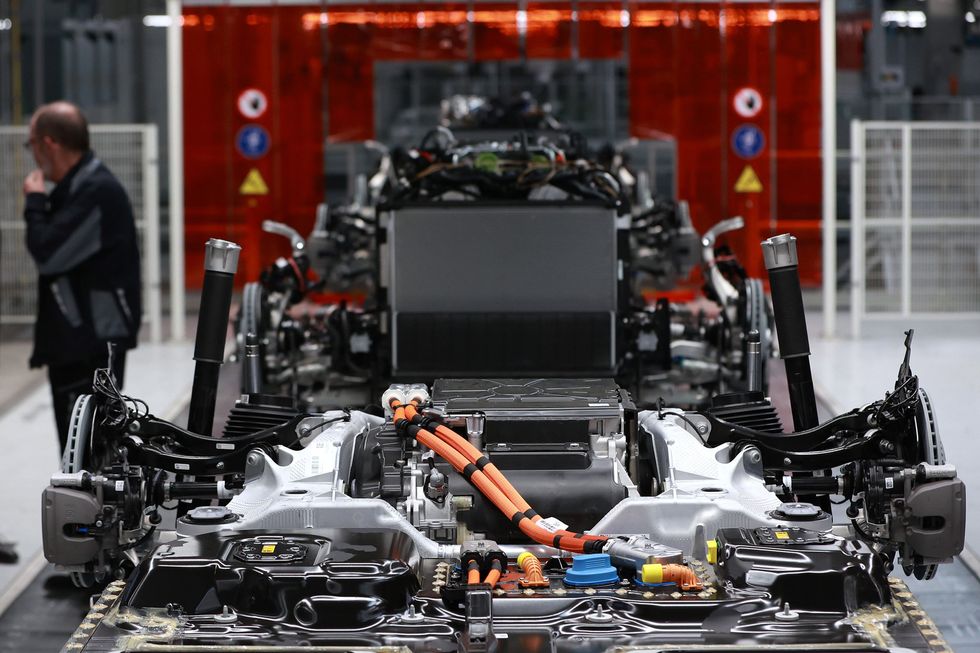

The drivetrain and battery of a Mercedes-Benz EQS electrical automobile on the meeting line on the Mercedes-Benz Group plant in Sindelfingen, Germany, on Monday, February 13, 2023. Krisztian Bocsi/Getty Pictures

The drivetrain and battery of a Mercedes-Benz EQS electrical automobile on the meeting line on the Mercedes-Benz Group plant in Sindelfingen, Germany, on Monday, February 13, 2023. Krisztian Bocsi/Getty Pictures

The tragedy, Castilloux says, is that EV demand was anticipated for a number of years, “however the motion is barely occurring now.”

“China was just one that acted on it, and is now a decade forward of the remainder of the world,” in each refining and processing battery supplies, and cell manufacturing itself.

Tesla additionally bought out in entrance of legacy automakers by pondering when it comes to vertical integration, the necessity to management your entire provide chain, from lithium brine and cobalt mines to remaining manufacturing and recycling.

“In latest a long time, it wouldn’t have made sense to consider an automaker turning into a processing or mining firm, however now with shortage of provides, they should take drastic measures.”

Dan Nicholson, Vice chairman of strategic tech initiatives Common Motors; board member Society of Automotive Engineers

Automakers are racing to fulfill hovering EV demand and fill yawning gaps available in the market, together with constructing a homegrown provide chain of battery supplies in addition to batteries. In america alone, Atlas Public Coverage tallies U.S. $128 billion in introduced investments in EV and battery factories and recycling. That also leaves one other blind spot: Charging infrastructure. Tesla’s dominant Superchargers apart, many consultants cite a patchwork, notoriously unreliable charging community as a number one roadblock to mainstream EV adoption.

“Charging infrastructure is on our want listing of issues that want to enhance,” mentioned Dan Nicholson, who helps lead Common Motors’ new charger initiatives.

The 2021 U.S. Infrastructure Regulation is offering $7.5 billion to construct a community of 500,000 EV chargers by 2030. However relatively than personal and function their very own chargers like Tesla—akin to automakers operating chains of proprietary gasoline stations—GM, Ford and others argue that standardized, open-source chargers are important to persuade extra Individuals to kick the ICE behavior. These chargers should be out there in every single place individuals dwell and work, Nicholson mentioned, and open to drivers of any automotive model.

It would assist if these chargers really work: A 2022 examine confirmed practically 25 p.c of public chargers within the San Francisco Bay space—itself a mecca for EV possession—weren’t functioning correctly.

Automakers and battery producers are on board with a number of options, together with the gorgeous rise of lithium-iron-phosphate cells in Teslas, Fords and different fashions.

To fill gaps in public networks, GM is collaborating with EVGo on a nationwide community of two,000 DC fast-charging stalls, positioned at 500 Pilot and Flying J journey facilities, most alongside main corridors. To achieve individuals the place they dwell, together with individuals with no entry to house charging, GM is tapping its greater than 4,400 sellers to construct as much as 10 Stage 2 charging stations every, at each sellers and key areas, together with underserved city and rural communities. Nicholson notes that 90 p.c of the U.S. inhabitants lives inside 16 kilometers of a GM supplier.

In his position as an SAE board member, Nicholson additionally helps future-proof requirements for EVs, connectors and chargers. That features the ISO 15118 worldwide normal that defines two-way communication between EVs and chargers. That normal is essential to “Plug and Cost,” the budding interoperability system that permits drivers of any EV to plug into any DC quick charger and easily be billed on the again finish. That’s how Teslas have labored since 2012, although with the benefit of a closed system that want solely acknowledge and talk with Tesla fashions.

Nicholson mentioned GM can be in search of “uptime ensures” with charging collaborators. That may enable drivers to see prematurely if a charger is operational, and to carry a spot.

“Individuals want to have the ability to reserve a station, and realize it’s going to work after they get there,” he mentioned.

Stephanie Brinley, principal automotive analyst for North and South America, S&P World Mobility

Regardless of an electrical growth yr in 2022, some analysts are downgrading forecasts of EV adoption, attributable to monkey wrenches of unpredictable demand, looming recession and supply-chain points. S&P World Mobility stays bullish, predicting that 42 p.c of worldwide patrons will select an EV in 2030, close by of President Biden’s objective of 50-percent EV penetration.

“That’s quite a lot of progress, however there are many individuals who received’t transfer alongside as shortly,” Brinley mentioned. Pushing EVs to a market majority would require stars to align. Brinley says probably the most important secret’s a continued explosion of latest EV fashions at each worth level—together with SUVs and pickups which are the lifeblood of U.S. patrons.

Concerning batteries, Brinley says ICE producers with an present manufacturing footprint, labor drive and know-how may discover a bonus over relative newcomers. The problem will probably be how nicely the likes of Common Motors and Ford can handle the transition, from scaling again on ICE manufacturing to retraining staff — fewer of whom could also be required to provide batteries and motors than ICE powertrains. In February, Ford introduced a brand new $3.5 billion plant in Michigan to construct LFP batteries, licensing tech from China’s CATL, at present the world’s largest lithium-ion producer.

“Some (legacy) automakers will use LFP for sure use circumstances, and solid-state in growth may change the dynamic once more,” Brinley says. “However in the intervening time, you want each batteries and engines, as a result of individuals will probably be shopping for each,” Brinley says.

In some unspecified time in the future, Brinley says, it’s a zero-sum recreation: A flat world marketplace for vehicles can’t comfortably accommodate each kinds of powertrains.

“ICE gross sales have to come back down for BEV gross sales to come back up,” Brinley says. “And that’s going to make for a wild market within the subsequent few years.”

Connor Hund, chief working officer, NanoGraf

NanoGraf is amongst a number of start-ups wishing for not simply longer-lasting batteries, however a steady, aggressive North American provide chain to counter China’s battery dominance. The Inflation Discount Act has spurred an unprecedented tsunami of homegrown funding, by requiring sturdy home sourcing of batteries and battery supplies as a situation of EV tax breaks for producers and shoppers. That features a $35-per-kWh tax credit score on each lithium-ion cell produced, and a $7,500 shopper tax break on eligible EVs.

Connor Hund says NanoGraf goals to onshore manufacturing of its silicon-anode materials at a brand new Chicago facility starting in Q2 this yr. The corporate, whose backers embody the Division of Protection, claims to have created the most energy-dense 18650 cylindrical cell but, at 3.8 amp-hours. The know-how secret’s a pre-lithiated core that permits an anode silicon proportion as excessive as 25 p.c, versus cells that sometimes high out at 5-to-7 p.c silicon.

“There’s actually room to spice up the vary of EVs by 20, 30 and even 50 p.c through the use of silicon,” he says.

However whether or not it’s NanoGraf, or the drive towards large-format 4680 cylindrical cells led by Tesla and Panasonic, scaling as much as mass manufacturing stays a significant hurdle. NanoGraf plans sufficient preliminary capability for 35 to 50 tonnes of its anode supplies. However it will want 1,000 tonnes yearly to crack the automotive house, with its now-bottomless urge for food for batteries—at aggressive price with what automakers at present pay for cells from China, South Korea or elsewhere.

“It’s so cutthroat in that house, and there’s a scale you must attain,” Hund says.

One want is being granted: Nobody is ready for a magic bullet in know-how, together with from strong state batteries that many consultants now insist received’t be prepared for vehicles till 2030 or later. As a substitute, automakers and battery producers are on board with a number of options, together with the gorgeous rise of LFP cells in Teslas, Fords and different fashions.

“There’s a scarcity of all these supplies, not sufficient nickel, cobalt or manganese, so corporations focusing on totally different shoppers with totally different options is basically useful.”

Western international locations have struggled to take a holistic view of all the pieces that’s required, particularly when incumbent options from China can be found. It’s not simply uncooked supplies, anodes or cathodes, however the cells, modules, electrolyte and separators.

“You want corporations onshoring all these parts to have a strong U.S. provide chain,” he says. “We want everybody upstream and downstream of us, whether or not it’s the graphite, electrolyte or separator. Everybody is only one piece of the puzzle.”

Hund says safer batteries must also be on the trade wish-list, as high-profile fires in Teslas and different fashions threaten to sully EVs fame or preserve skeptical shoppers on the fence.

“We will’t have batteries self-discharging on the fee they’re now,” he says, particularly with automakers gearing up all over the world for his or her largest EV invasion but.

“Getting forward of this now, versus pushing hundreds of thousands of vehicles onto the street and coping with security later, is essential.”

From Your Web site Articles

Associated Articles Across the Net

[ad_2]

No Comment! Be the first one.