What to anticipate because the US continues with debt ceiling negotiations | Politics Information

[ad_1]

Tensions are mounting because the deadline for the US to lift its spending limits and keep away from a doubtlessly disastrous default looms on the horizon.

Republican Home Speaker Kevin McCarthy is assembly US President Joe Biden on Tuesday to debate potential pathways ahead. The US Division of the Treasury has warned that it may run out of funds to cowl the nation’s payments as early as June 1.

In US politics, it falls to Congress to lift spending limits and keep away from default. McCarthy has stated that he is not going to accomplish that with out an settlement to chop spending on social programmes.

The consequence has been a standoff by which little progress has been made, at the same time as consultants have warned {that a} default may have calamitous results on the US financial system.

“Each single day that Congress doesn’t act, we’re experiencing elevated financial prices that might decelerate the US financial system,” Treasury Secretary Janet Yellen stated on Tuesday. “There isn’t any time to waste.”

President Biden is scheduled to depart on Wednesday for a visit abroad to attend the Group of Seven (G7) summit in Japan. However officers introduced on Tuesday that he would return over the weekend, nixing earlier plans to make stops in Australia and Papua New Guinea to fulfill with leaders there.

Listed here are a number of the particulars about who’s concerned within the debt ceiling negotiations, what will be anticipated within the days forward, and what wouldn’t it imply for the US to default on its debt.

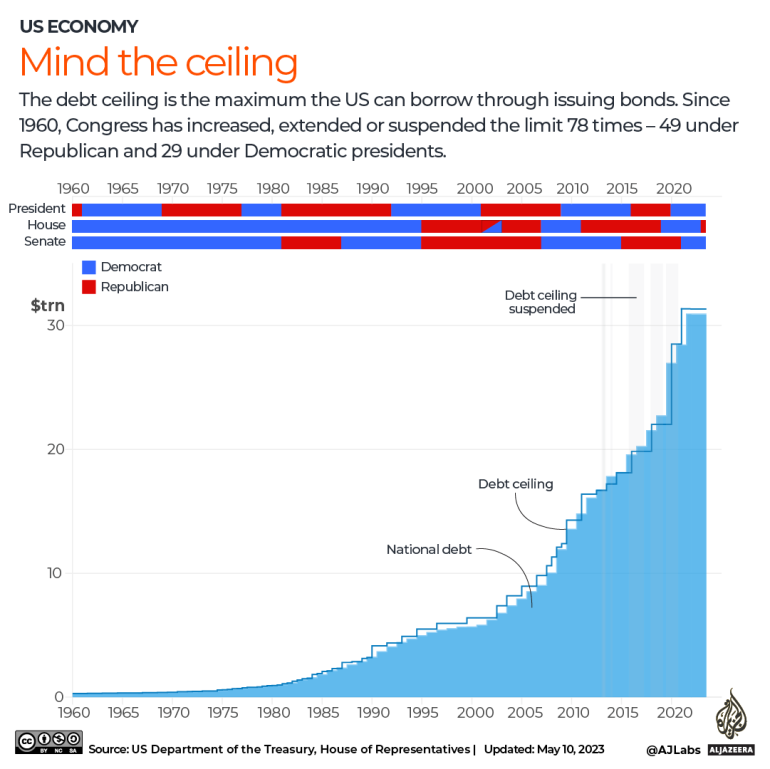

What’s the debt ceiling?

The debt ceiling is the US spending restrict, at the moment set at about $31.4 trillion. Usually, elevating the federal government’s spending limits is a routine process. However what was as soon as a reasonably uncontroversial course of has turn out to be more and more politicised over time.

When was it final raised?

The debt ceiling was final raised in 2021, when Democratic lawmakers within the Home and the Senate elevated spending limits with little drama.

Right now, Democrats management the White Home and the Senate, however Republicans have a majority within the Home of Representatives.

McCarthy, going through stress from his get together’s proper flank, is utilizing Republican leverage over the debt ceiling to push for spending cuts and better restrictions to programmes similar to meals help for low-income households.

“Avoiding an unprecedented default is a fundamental obligation of Congress,” Biden stated in a Twitter put up on Tuesday. “And Home Republicans realize it — they averted default thrice below my predecessor, with out as soon as threatening our financial system. Default shouldn’t be an possibility.”

Avoiding an unprecedented default is a fundamental obligation of Congress.

And Home Republicans realize it – they averted default thrice below my predecessor, with out as soon as threatening our financial system.

Default shouldn’t be an possibility.

— President Biden (@POTUS) Could 16, 2023

What are members of every get together saying?

McCarthy and the Republican Occasion have stated that they’re making an attempt to rein in authorities spending.

“We will elevate the debt ceiling if we restrict what we’re going to spend sooner or later,” McCarthy informed reporters on Tuesday.

These limitations are largely targeted on social programmes, and embody proposed work necessities for meals help.

Republican calls for have left the nation’s greater than $850bn army price range largely untouched. In the meantime, Democrats have capitalised on the truth that Republican lawmakers have raised spending limits with little fuss when their very own get together is in energy.

“Republicans exploded our debt after they gave enormous tax breaks to the wealthy. Now, they’re refusing to lift the debt restrict and pay the invoice — risking a worldwide financial disaster until they’ll intestine Social Safety, Medicare & Medicaid,” Senator Bernie Sanders stated in a social media put up in January.

“America can not default on its debt. If we have been to try this it will be catastrophic,” Biden stated in a video posted on Twitter on Tuesday. “It’s past comprehension. No severe particular person in both get together has ever thought this was an possibility.”

What occurs if the US defaults?

The US defaulting on its debt could be uncharted territory, however consultants agree on one key level: Doing so could be deeply unsettling for each the US and world economies.

Treasury Secretary Yellen has beforehand warned that if the US doesn’t elevate the debt ceiling by early June, default would set off an “financial and monetary disaster”.

“A default would elevate the price of borrowing into perpetuity. Future investments would turn out to be considerably extra pricey,” Yellen informed a gaggle of businesspeople in April.

Final week, the Worldwide Financial Fund (IMF) likewise acknowledged {that a} US default would have “very severe repercussions” all over the world, together with a possible slowdown in world gross home product (GDP) progress.

If the federal government is unable to cowl its payments after June 1, federal employees may see delays of their pay and the federal government may wrestle to keep up some features.

What’s the standing of talks?

Biden and McCarthy met on Tuesday, alongside different members of Democratic and Republican Congressional management, the second assembly of its form within the final week.

Republican Senator John Thune informed reporters on Tuesday that there have been “too many cooks” within the negotiations, and that talks ought to be restricted to Biden and McCarthy.

Including to the problem is the truth that McCarthy, who was elected Republican chief of the Home after a contentious and drawn-out course of after the 2022 midterm elections, is susceptible to assaults from hardliners inside his get together.

Regardless of the obstacles, Biden sounded an optimistic word over the weekend, stating that there was “a need on their half in addition to ours to succeed in an settlement”.

[ad_2]

No Comment! Be the first one.